Wednesday, 27 July 2016

Hony Nb Sub eligible for pension of Nb Sub

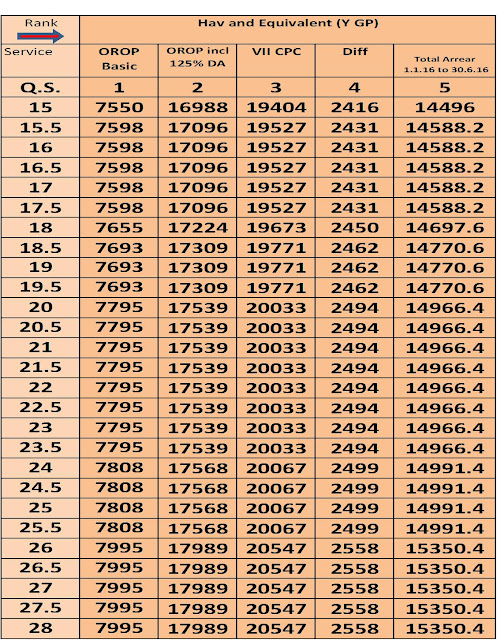

Havildar granted rank of Hony Nb Sub after retirement is eligible for pension of Naib Subedar rank in accordance with letter No.1(8)/2008-D-P (Pen/Policy) dt 12.6.2009 issued by the Government of India, Ministry of Defence (Department of Ex serviceman Welfare), New Delhi – AFT Decision

Gud effort,forgot 6th CPC arrears to add with?

ReplyDeleteOrop calculated 1/7/2014.now 7th pay commission also calculated on the basis of orop.what about 1/1/2016 basic calculations and no msp also includes.

ReplyDeleteMultiplication factor of pension by 2.57 ONLY,will be beneficial to the pensioners.Total of Basic+MSP+ Group pay will not be useful to any PBOR pensioners.Because Justice Mathur has done great injustice to armed forces in fixing the pay and perks.Our Chiefs have to act.

DeleteIf the pension as on 31.12.15 multiplied by 2.57 to get new pension, then what for Pay matrix table. Is it not applicable for pensioners?. Secondly what about 50% of the revised MSP. Are we not entitled 50% of the revised pay as pension?

ReplyDeleteYour query is very much correct.As per the 7th CPC a current pensioner'eligible pension is arrived by either of the two methods as follow..

Delete1.Multiplying the current basic pension by 2.57

2.50% of the revised pay(basic pay+MSP+ Group pay),

corresponding to the pre revised pay scale from which the pensioners retired. Whichever the amount is greater and beneficial to the pensioner,that will be his basic pension.

A most important point to take note of is " go through the committee report (separate pay matrix for civil and defence and see for yourself what is the basic of a JCO in comparison with the tradesman

in technical service in government job

Multiplying factor is less than 50 % of revised pay plus MSP in many cases. If future DA is considered t will be loss for many defence pensioners.

ReplyDeleteIt may be in the case of PBORs who had retired with more than 28 years of service.So in that case 50 % of the corresponding revised basic pay will be applicable.It is very rare and few negligible percentage of people who may be fitting in to this category.

Delete2.57 multiplied with OROP basic, 50% of revised MSP left out ?

ReplyDeleteas and when arrears of orop and the arears of pay amamolies from 01 january 2006 to december 2011

ReplyDeleteOROP amount should be multiplied by 2.57 to arrive the 7th cpc amount. I do not know how option 1 will be considered as there is no time bound for the same. It should also be completed within a stipulated time. I appreciate the calculation work to ease out the pension distributing agency.

ReplyDeleteWHAT EVER IT IS WHEN WIILL IT BE CREDITED TO OUR ACCUNTS

ReplyDelete